Property Search

Property Search Infor mation

Court Docket

lorain county Docked

Tax Estimator

Tax Estimator in Lorain

Jail Inmate

Jail Inmat Search

Explore Lorain County property records with our fast and accurate Property Search Tool. Access detailed parcel information, ownership history, and tax data all verified by Lorain County Auditor J. Craig Snodgrass. This trusted property search service helps homeowners, buyers, and investors find complete and updated real estate information across Lorain County. Use our easy property search system to get reliable and comprehensive results anytime.

Best Ways to Perform a Property Search in Lorain County

Searching for property information in Lorain County, Ohio becomes easier when you use the right online tools and official resources. The best place to start is the Lorain County Auditor’s website, where you can access property tax details, ownership history, parcel numbers, market values, and interactive maps. You can search by owner name, address, or parcel ID for fast and accurate results. For deeper research, the Lorain County Recorder’s Office provides access to deeds and legal documents related to the property. Using these trusted sources helps homebuyers, investors, and real-estate agents make informed decisions with up-to-date property data.

Lorain county Property Search by Address

The Lorain County Auditor’s website offers a convenient Property Search by Address feature that helps users quickly find detailed property information. By entering a property’s street address into the search bar, you can instantly access important records such as the owner’s name, parcel number, assessed property value, tax details, and land or building information. This tool is especially helpful for homeowners, buyers, real estate agents, and investors who need accurate and up-to-date data about any property in Lorain County. The search system is fast, reliable, and easy to use, making it one of the best ways to explore property records directly from the Lorain County Auditor’s official website.

You said:

Lorain county Property Search by Owner

The Lorain County Auditor’s online property search tool allows you to find property records by entering the owner’s name. Instead of searching by address or parcel number, you can choose the “Search by Owner Name” option, type in the full or partial name of the property owner, and the system will display all matching properties in Lorain County. This search returns details such as the owner’s name, mailing and property addresses, assessed property value, land and building information, tax history, and links to parcel maps—all pulled from official county records. To get the best results, it helps to enter at least three characters of the owner’s name and try variations if needed.

Lorain county Property Search by Tools

The Lorain County Property Search Tools offered by the Lorain County Auditor provide a fast, accurate, and convenient way to explore property information online. Whether you are a homeowner, buyer, seller, real estate agent, or investor, these tools make it easy to find complete and updated details about any property in Lorain County, Ohio.With the Property Search by Tools, users can search properties using multiple options such as Address Search, Owner Name Search, Parcel Number Search (Parcel ID), and Advanced Search Filters. These search methods help you access essential information like current property value, tax assessments, land records, ownership history, sales data, and property characteristics.

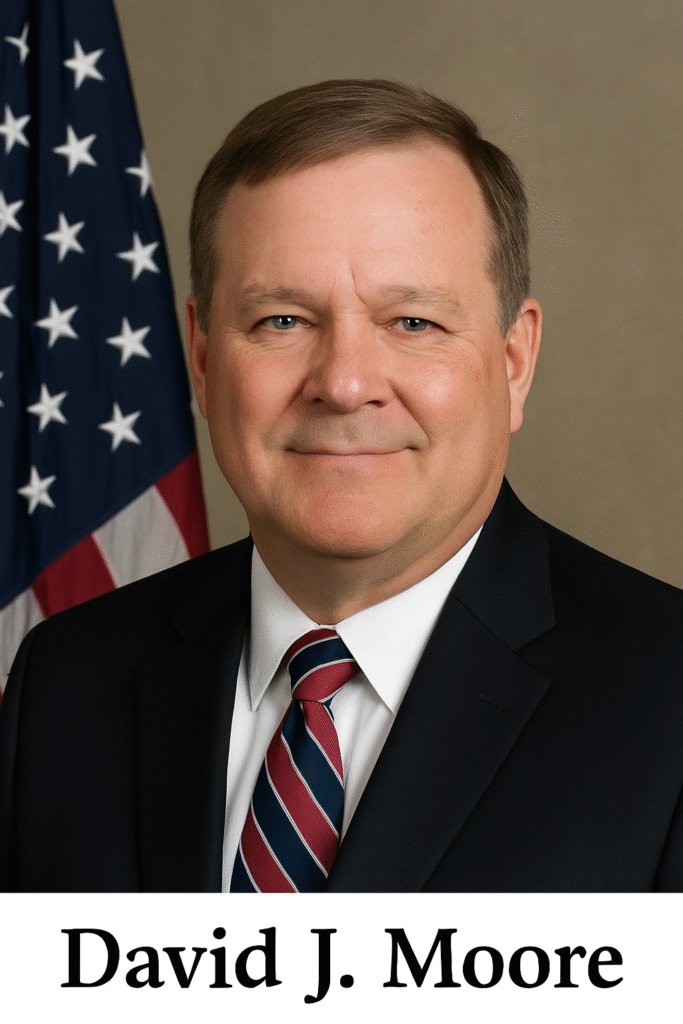

J. Craig Snodgrass Lorain County Auditor

J. Craig Snodgrass brings extensive public service experience, financial expertise, and a strong commitment to transparency and accountability to his role as Lorain County Auditor in Ohio. As the chief financial officer and official property tax assessor, Auditor Snodgrass oversees fiscal operations, property valuation, tax distribution, and the management of public records for the county. Under his leadership, the Auditor’s office emphasizes fairness in property assessment, integrity in financial reporting, and accessibility of public data. The office leverages modern tools such as online property search systems, GIS parcel maps, tax estimators, and digital records platforms to deliver accurate and timely property and tax information to residents, businesses, and local officials. By focusing on innovation, community engagement, and transparent service, he works to make Lorain County’s property records and financial systems clear, reliable, and useful for everyone in the community. loraincountyauditors.online

Leadership in Lorain l County (Ohio)

David J. Moore is a public leader and political figure in Lorain County, Ohio, where he has been active in local government and community development. He ran for County Commissioner with a focus on moving the county forward and improving how local services and government function for residents. Under his leadership, he has emphasized building strong teams within county government, tackling issues such as developing micro-transit systems, revitalizing underused properties to create jobs, and upgrading sewer and infrastructure systems to support growth and quality of life. Moore positions his leadership as a break from old political practices, advocating for generational progress and community pride in Lorain County’s future.

Trumbull County Auditor Roles and Responsibilities

The Lorain County Auditor is responsible for ensuring accurate property assessments, maintaining current and reliable tax records, and overseeing the fair distribution of property tax revenues throughout the county. The Auditor’s office manages public records, processes tax exemptions such as the Homestead Exemption, and provides residents with transparent, accessible information related to property values and taxation. These responsibilities help promote fair taxation, financial accountability, and dependable public data across Lorain County.

Property Valuation, Assessment, and Taxation

Property valuation, assessment, and taxation involve determining the accurate market value of real estate, calculating taxes based on these values, and ensuring fair tax collection. This process supports public services funding and maintains transparency in property records.

Financial Control and Payroll Services

Financial control and payroll services manage the county’s budget, monitor expenditures, and ensure accurate employee payments. These services maintain fiscal responsibility, streamline payroll processing, and support efficient financial operations for government departments and public services.

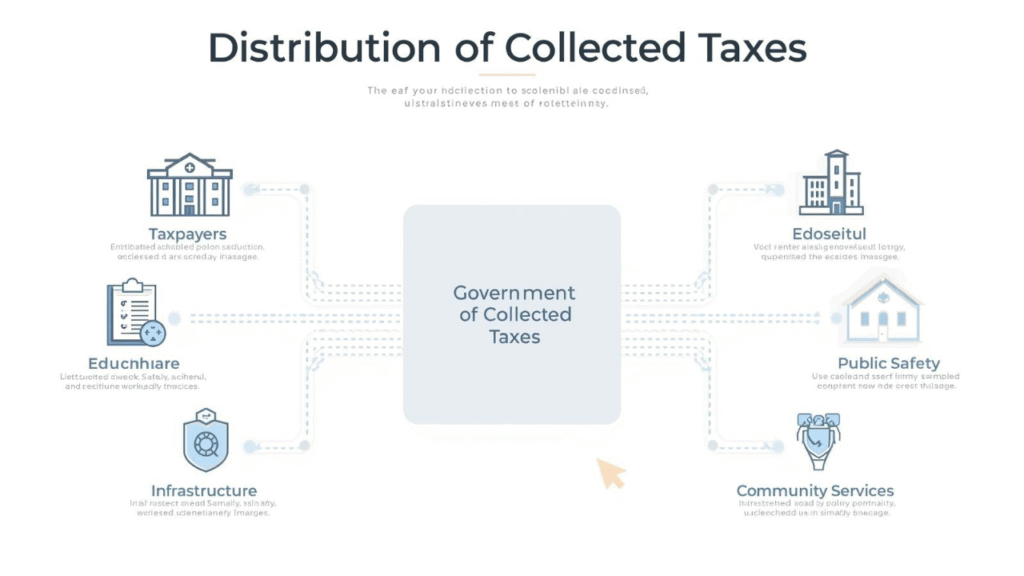

Tax Revenue Distribution

Tax revenue distribution refers to the allocation of collected taxes among schools, public safety, infrastructure, and local services. This process ensures funds are shared fairly to support community development, essential programs, and effective government operations

Licensing and Permit Management Services

The Lorain County Auditor’s Office manages the issuance and renewal of licenses and permits, including vendor, dog, and cigarette licenses. These services ensure legal compliance, accurate recordkeeping, and transparent licensing processes for residents and businesses across the county.

Weights and Measures Verification Services

The Lorain County Auditor’s Office inspects and verifies commercial scales, gas pumps, and measuring devices to ensure accuracy, fairness, and compliance with Ohio state standards, protecting both consumers and businesses.

Digital Transparency and Public Records

The Lorain County Auditor’s Office ensures full digital transparency by providing residents and businesses with easy access to comprehensive property, tax, and financial records, maintaining accountability, promoting public trust, and fully complying with Ohio’s public records laws and regulations.

Key Roles of the Trumbull County Auditor

The Lorain County Auditor plays an important role in managing the county’s financial and property records. The Auditor is responsible for ensuring that property values are assessed fairly and accurately so that property taxes are distributed correctly. The office maintains up-to-date tax maps and ownership records for all real estate in the county.

The Auditor also calculates property taxes, prepares the county’s tax duplicate, and works closely with local governments, schools, and taxing authorities to ensure proper funding. In addition, the office processes tax exemptions, such as the Homestead Exemption, and provides public access to property and tax information.

Key Services Provided by the Lorain County Auditor’s Office

The Lorain County Auditor’s Office provides essential services to ensure accurate property assessments and fair taxation across the county. Key services include maintaining updated property records, calculating and distributing property taxes, and processing exemptions such as the Homestead Exemption. The office also monitors financial records, coordinates with local governments and schools, and assists residents with tax-related inquiries. By offering public access to property and tax information, the Auditor’s Office promotes transparency, accountability, and efficient management of county resources.

Property Assessment Review Board

The Lorain County Board of Revision reviews property owners’ complaints about tax assessments, holds hearings, and can adjust property values to ensure fairness and accuracy.

Property Parcel Viewer

The Lorain County Property Parcel Viewer provides easy online access to parcel maps, ownership, and tax information for all properties in the county.

Sales Data Report

The Sales Data Report in Lorain County provides searchable records of property sales, including sale prices and dates, to promote transparency and help users analyze real estate market trends and property value history.

Court Case Calendar

The Lorain County Court Case Calendar provides an official schedule of upcoming court hearings and trial dates for the county’s courts, helping the public and legal professionals stay informed about case proceedings.

Court Records Clerk

The Court Records Clerk at the Lorain County Clerk of Courts Office manages, organizes, and preserves official court documents, helping the public and legal professionals access case records and certified copies.

Administrative Records

Administrative Records in Lorain County consist of official documents detailing government operations, decisions, and procedures, maintained and stored for legal compliance, transparency, and public access.

Lorain County Auditor Records and taxes

Marriage & Divorce Records Office

Marriage records in Lorain County are issued by the Probate Court, while divorce records are maintained by the Domestic Relations Division of the Clerk of Courts, and certified copies can be requested from these offices.

Applicable Tax Rates

In Lorain County, the property tax rate varies by local district and averages about 1.5–1.8% of assessed value, while the combined sales tax rate for goods and services is generally 6.50%, including state and county taxes.

Real Estate Tax Rates

Lorain County Real Estate Taxes: Assessed at 35% of market value, average rate ~1.82%, varies by city/school district, with exemptions available; paid in two yearly installments.

Sales Tax Details

Lorain County Sales Tax: Total ~6.5% (State 5.75% + County 0.75% + possible local add-ons). Applied on retail purchases; some items may be exempt.

Regional Tax Resources

RITA (local income tax), Ohio Dept. of Taxation (state forms), County Auditor/Treasurer (property tax), free help via VITA/AARP/United Way.

Jail Inmate Locator

Online tool to search inmates by name or ID. Shows booking info, charges, bond, and release date. Website: lorain.countyjail.org or call 440‑329‑3709.